Bitcoin to $100k? A Skeptical Take

Okay, so Bitcoin's gonna hit $100k, huh? That's the word on the street, apparently. "Major resistance broken," they say. "Next stop, the moon!" Give me a break. Every crypto "expert" has been predicting the next big rally since, well, since the last big crash. And how many times have they been right? About as often as a broken clock.

The Alleged "Sure Thing" Factors Driving the Price

Let's look at these so-called "guarantees." First, the Fed's easing up on the money supply. Okay, fine. That could help. But it also means inflation could spike again, and then what? Back to square one, only this time with even more debt. It's like trying to put out a fire with gasoline, if you ask me.

Vanguard's Entry: A Sign of the Times?

Then there's Vanguard, suddenly all buddy-buddy with Bitcoin. Nine trillion dollars under management, and now they're letting clients dabble in crypto ETFs? What changed? Did they suddenly develop a conscience and decide to democratize finance for the masses? Offcourse not. They smell money, plain and simple. And when the big boys smell money, you can bet they're gonna take their cut, leaving the little guys holding the bag when the music stops.

The Illusion of Technical Analysis

And of course, the technical analysis. "Volatility at historic lows!" they scream. "Parabolic move incoming!" You know what else happens before a "parabolic move"? A whole lot of nothing. Charts are just squiggles on a screen until they aren't. They're tea leaves for finance bros, not a crystal ball.

The Overlooked Risks and Fragility of the Market

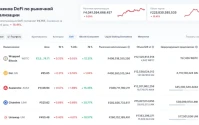

But here's the part everyone conveniently forgets: the market's still fragile. "Not enough trading volume," they admit. Translation: this whole thing could collapse at any minute if someone sneezes the wrong way. One bad tweet, one unexpected sell-off, and boom – liquidation cascade. Remember October 10-11? $19 billion GONE. Poof. And we're supposed to believe it can't happen again?

Questioning the "Fundamental Drivers"

They say "fundamental drivers" are strong, like central bank money and institutional demand. Okay, but what happens when those "fundamentals" change? What happens when the Fed reverses course AGAIN? What happens when Vanguard decides crypto's not so hot anymore and pulls the plug? Suddenly, those "strong drivers" are a runaway train heading straight for a cliff.

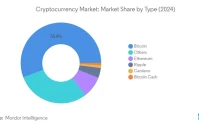

The Stablecoin Wildcard: Tether and Circle

Oh, and let's not forget Tether and Circle minting billions in stablecoins. "Liquidity retention and new capital entering crypto!" they cheer. Yeah, or maybe it's just more funny money propping up a house of cards. Tether ain't exactly known for its transparency, is it? And if those stablecoins ain't fully backed by real dollars… well, let's just say things could get ugly real fast. According to Tether, Circle Minted $20B Stablecoins Since October 10th Crash; What’s Next?, billions in stablecoins have been minted since the October crash.

Navigating Weekend Volatility and Whale Manipulation

And speaking of ugly, let's talk about weekends. Low volume, high volatility. The perfect recipe for getting rekt. Apparently, there are key liquidation levels to watch – $108k, $111.5k, $113k. Whoop-dee-doo. Knowing the levels doesn't mean you can dodge the bullet. It just means you'll see it coming before it hits you.

The Whale Game: A Different Set of Rules

Whales are supposedly "positioning for upward movement." Yeah, well, whales are always positioning for something. They're playing a different game than the rest of us. They can manipulate the market with a single transaction. We're just along for the ride, hoping we don't get thrown off.

Final Thoughts: Proceed with Caution

Look, I ain't saying Bitcoin's going to zero. Maybe it will hit $100k. Maybe it'll go even higher. But I'm not betting the farm on it. This whole thing feels like a giant game of musical chairs, and I don't want to be the one left standing when the music stops. Too much hype, too much speculation, and not enough real substance. The smart move? Take profits when you can and don't get greedy. Because in the end, the only guarantee in crypto is that there are no guarantees. And anyone who tells you otherwise is probably trying to sell you something.