Giann Liguid's Crypto Crystal Ball: Will Regulation Save Us, or Just Ruin the Party?

Okay, so Giann Liguid, some Ateneo grad who apparently spends his free time "thrift shopping for his dogs," is now telling us what's up with crypto? Give me a break. Is this the best we've got?

The "Stabilization Phase": Code for "Boring"?

"Crypto Market Enters a Stabilisation Phase, Experts Say." Oh, joy. Stabilization. In crypto. That's like saying a punk rock concert is entering a "polite applause" phase. The whole point is supposed to be the wild west, the unpredictable gains (and, yeah, the soul-crushing losses).

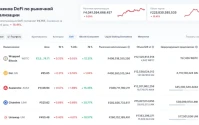

They're saying debt is down, short-term holders are crying into their ramen, and some indicator called SOPR is doing… something. Who cares? It's all just jargon to make it sound like they know what they're talking about.

And then the institutions swoop in. BlackRock buying up Bitcoin ETFs? Texas investing in Bitcoin? That’s not stabilization; that's the freaking establishment moving in to gentrify the neighborhood. Next thing you know, Bitcoin's gonna be wearing khakis and playing golf.

Regulation: The Kiss of Death?

TRM Labs is patting itself on the back because "increasing regulatory clarity also created major tailwinds for institutional adoption." Translation: the suits are here, and they're bringing their rulebooks.

Stablecoins are the big focus, apparently. Everyone's trying to figure out how to wrangle these things, from the US with the GENIUS Act (seriously, who names these things?) to the EU's MiCA rollout. They think stablecoins are gonna be some kind of "medium of exchange" on blockchains. As if anyone actually uses crypto for buying groceries. It's all speculation, baby.

But here's the thing: regulation always sounds good on paper. "Protecting consumers," "combating illicit finance"... But what it really means is control. More red tape, more compliance, more ways for the government to stick its nose where it doesn't belong.

And don't even get me started on the North Korea Bybit hack. They lost over a billion in Ethereum. A BILLION. And the solution is...more regulation? That's like trying to stop a flood with a paperclip.

Offcourse, they say regulation is working because VASPs (Virtual Asset Service Providers, for those of you not fluent in alphabet soup) have lower rates of illicit activity. But that's because the criminals just move somewhere else. It's like squeezing a balloon – the air just goes to a different spot. According to the Global Crypto Policy Review Outlook 2025/26 Report, regulatory clarity is increasing.

Bitcoin's Price Rollercoaster: Hold On Tight

So, Bitcoin's taking a nosedive, huh? Down 6.4 percent in a day. "Largest single-day decline in a month," they say. And it's all the Bank of Japan's fault?

Linh Tran from XS.com says it's a "strong correction and restructuring phase after a period of overheating." What a load of garbage. It's volatile. It goes up, it goes down. That's the whole damn thing.

And then Farzam Ehsani from VALR chimes in about MSCI potentially excluding Strategy from global indices. Who the hell cares about some index? This is crypto! We're supposed to be outside the system.

They're talking about "technical support levels" and "oversold territory." It's all just tea leaves. Nobody knows what's gonna happen.

Goldman Sachs buying Innovator Capital Management? Tether getting downgraded by S&P? Japan preparing a 20 percent flat tax? It's a freakin' circus. Every day is a new drama, a new crisis, a new opportunity to lose all your money.

But maybe...maybe I'm just being too cynical. Maybe there's something to this whole "stabilization" thing. Maybe regulation will actually make crypto a legitimate asset class.

Nah. Who am I kidding?