AI, Crypto, and Debt: A Perfect Storm of Stupid?

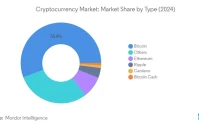

The Holy Trinity of Doom So, we've got AI blowing up like a teenager's pimple, crypto still trying to convince us it's not just magic beans, and debt... oh sweet, sweet debt, piled higher than my student loans ever were. And these things are all tangled together like a bad hair day after a windstorm. The FT article mentions Nvidia raking in $57 billion in three months. Fifty-seven *billion*! For chips that train AI. It's like the gold rush all over again, except instead of pickaxes, we're wielding lines of code. But is it real? Or is it just really good marketing? I mean, Google's CEO is already warning about the AI bubble bursting. No company immune, he says. Yeah, right. Tell that to the shareholders who are gonna lose their shirts. Then there's crypto. Bitcoin taking a nosedive. Shocker. Turns out, digital fairy dust ain't exactly a stable investment. Who knew? And now countries are stockpiling this stuff? Are they nuts? It's like they're prepping for some kind of digital apocalypse where the only currency that matters is... well, the same volatile garbage that's been crashing and burning for years. Makes perfect sense. And let's not forget the debt. Over $100 trillion in public debt globally. Kenya using half its revenue just to pay off loans. The US on track to out-debt Italy and Greece. It's like watching a slow-motion train wreck, but instead of trains, it's entire nations. And a big chunk of that debt is going towards... you guessed it, AI infrastructure. So we're borrowing money we don't have to build something that might be completely worthless in a few years. Brilliant!Historical Comfort? More Like a Slow-Motion Train Wreck.

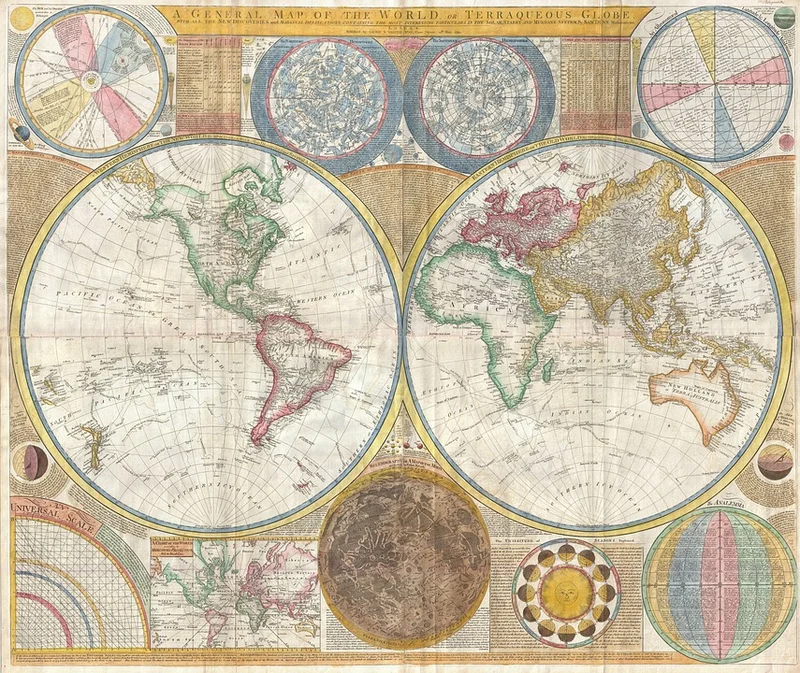

Echoes of the Past (and Why They Don't Help) Everyone's digging up old historical parallels – the railroad mania, Dutch tulip fever. Trying to find some comfort in the fact that we've been here before. But here's the thing: those bubbles burst, and while they sucked, they didn't have the potential to take down the entire global economy. This feels different. This feels... bigger. The article suggests that Europe's slower approach to AI might be a good thing, protecting them from an "oversupply bubble." Maybe. Or maybe they're just going to get left behind while the rest of the world charges ahead (possibly off a cliff). And gold is making a comeback? Seriously? Are we going back to bartering shiny rocks for survival? Hold on... I need a drink."Grand Plan" or Just a Shiny Distraction?

The Unasked Questions Where are the adults in the room? Why is everyone so damn eager to throw money at anything with "AI" or "crypto" in the name? And who's actually doing the math here? Are we just blindly following the hype, or is there some kind of grand plan that I'm too cynical to see? The article mentions "lasting value" even if the initial investors get screwed. So basically, we're building a future that benefits someone else, while we're stuck holding the bag? Thanks, I hate it. We're Officially Screwed