GoPlus: Security Savior or Fear Profiteer?

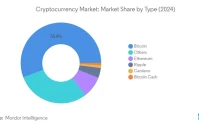

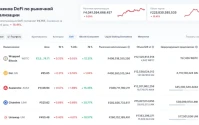

GoPlus: A DeFi Security Success Story? GoPlus, a security service provider in the DeFi space, is an interesting outlier. They generated $4.7 million in revenue as of October 2025. The GoPlus App is the biggest driver, contributing about 53% ($2.5 million), followed by their SafeToken Protocol at $1.7 million. The Token Security API averaged 717 million monthly calls year-to-date, peaking at nearly a billion in February. That's a lot of security checks. Since its launch in January 2025, the $GPS token has seen over $5 billion in spot volume and $10 billion in derivatives volume. Monthly spot volume peaked in March at over $1.1 billion, with derivatives volume topping $4 billion. This raises a question: Is GoPlus a genuine success story, or is it simply profiting from the increased fear and uncertainty in the DeFi market? (A bit of both, I suspect.) I've looked at hundreds of these token reports, and the correlation between perceived risk and security service revenue is almost always positive. It's a classic "picks and shovels" play during a gold rush—or, in this case, a crypto rush.October's "Crash": Orchestrated Dip or Genuine Panic?

Market Sentiment and Future Catalysts Investor sentiment is a mixed bag: confused, resolved, and, perhaps most importantly, humble. Some are moving towards safer DeFi tokens or those with fundamental catalysts. There's optimism around HYPE's "perps on anything" markets, which are seeing high volumes. And the market is seeing more developed put skew in Bitcoin, which is viewed as a healthy sign of market maturation. But here's where the data gets a little *too* neat. Big wallets that supposedly sold Bitcoin above $100k are now buying back 20% lower. Trend signals allowed some funds to step out of the way weeks ago and accumulate dry powder. It's all a bit too convenient, isn't it? It suggests that some players knew this pullback was coming and positioned themselves to profit from it. BlackRock registering the iShares Staked Ethereum Trust in Delaware—that's a significant move. It signals their intention to launch a yield-generating ether ETF. Mastercard expanding its Crypto Credential system to self-custody wallets, using Polygon's blockchain for KYC-verified identities, is another potential catalyst. And Metaplanet unveiling a two-tier preferred share structure with a $150 million perpetual preferred offering...well, that's just Metaplanet being Metaplanet. (A company that is publicly traded and buys Bitcoin as their primary treasury reserve asset. It's a weird, but interesting, strategy.) A Calculated Dip Before the Next Run? The question isn't whether the October crash happened; it's what it *means*. The data paints a picture of a market correction driven by a combination of profit-taking, macroeconomic uncertainty, and perhaps a bit of orchestrated manipulation. While some are running for the exits, others are quietly accumulating. Is it a buying opportunity? Possibly. But it's not a risk-free one. Approach with caution and, as always, do your own damn research.